Access to capital can be a “make-or-break” issue for farmers or aspiring producers who need financial support to launch their agriculture operation. That’s why the United States Department of Agriculture (USDA) Farm Service Agency (FSA) offers a wide variety of lending programs for beginner or experienced farmers to start, improve, expand, or transition family farming and ranch operations. However, when starting the initial search for USDA farm loans, it can be difficult for farmers to get a quick snapshot of how to best leverage Agency resources based on their unique financing needs. In this article, we’ll breakdown three areas of the FSA lending process to help farmers navigate where to start when exploring USDA farm loans.

1. The Difference Between Direct and Guaranteed USDA Farm Loans

The FSA administers both direct and guaranteed financing through many of the same programs it offers (although guaranteed loans are equipped with higher maximum loan amounts than direct loans). Farmers apply for direct loans through a local FSA county office whereas guaranteed loans are made by a financial institution, and the FSA guarantees up to 95% of the loan, protecting the lender against the possible loss of principal and interest.

- Direct Loans: These loans are for farmers who have limited financial history to qualify for commercial credit or who have experienced financial setbacks as a result of a natural disaster. The money used to fund these loans comes from Congressional appropriations received as part of the USDA’s annual budget. Farmers must apply for direct loan assistance in-person at an FSA county office or through a local USDA Service Center. A loan officer with the FSA will meet with the applicant to assess all aspects of their financial situation, including whether or not eligibility requirements will be an issue. Approved borrowers who choose to receive a direct loan from the FSA are required to attend borrower training, which typically consists of a classroom type workshop on financial management.

- Guaranteed Loans: These loans are for farmers who may not be able to obtain a conventional loan from a commercial lender. Farmers apply for guaranteed loans as they normally would with any commercial lender. The commercial lender must be USDA-approved to participate in the FSA guaranteed programs. The lender will first analyze the business plan and financial condition of the operation. If the farm loan proposal looks realistic and there is sufficient collateral, but it cannot be approved because it does not meet the lending institution’s typical underwriting standards, the lender may apply for an FSA loan guarantee directly with the Agency. If approved, the FSA provides oversight of lenders’ ongoing loan servicing activities and in the event the lender suffers a loss, the FSA will reimburse the lender according to the terms and conditions of the specific guarantee.

Often times, farmers may go the route of starting out with a direct loan application, but the Agency will want to see that a guaranteed loan was first considered.

The FSA ultimately seeks to help farmers graduate to being able to obtain credit from a commercial lender. Once they are able to do so, their “mission of providing temporary, supervised credit is complete.” If qualifications for a guaranteed loan from a lender are not met, a direct loan can be provided by FSA assuming the applicant is a beginning farmer or has not had a prior direct loan outstanding for more than the term limits of the loan. In addition, the applicant must be able to demonstrate sufficient education, training, and experience in managing or operating a farm.

2. The Different Types of Guaranteed FSA Loans

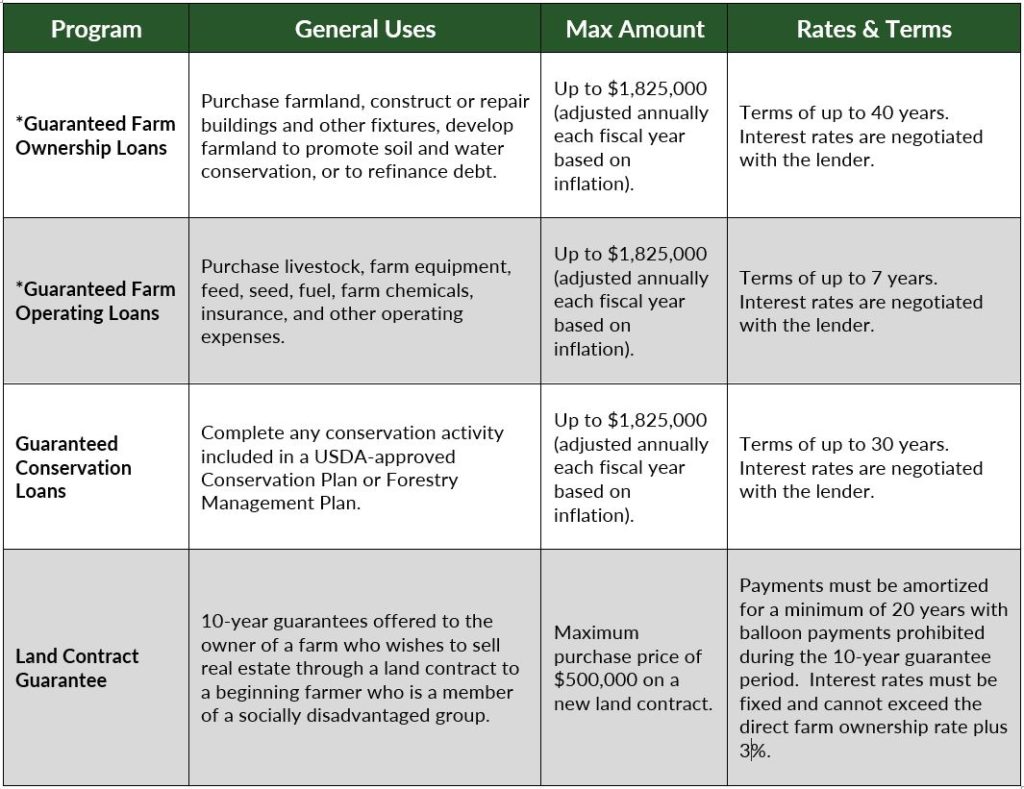

Since the first step involves researching guaranteed FSA loan program options, the remainder of this article will focus only on those programs available through the Agency that are made by commercial lenders. Although there are four programs available for guaranteed financing, Guaranteed Farm Ownership and Guaranteed Farm Operating loans are by far the most commonly utilized by borrowers. The below chart provides a brief summary of the uses, maximum amounts and terms available through each guaranteed program.

*Streamlined financial underwriting is available through an EZ Guarantee for loan applications up to $100,000 for Guaranteed Farm Ownership Loans and Guaranteed Farm Operating Loans. All existing eligibility, loan purpose, security, and other requirements remain the same.

It’s important to keep in mind that direct financing may also be available through one or more of the four programs outlined above but the loan amounts and terms will differ. When looking at the different guaranteed loan programs, financing needs should align with the appropriate loan type based on criteria of the program.

3. The Eligibility Requirements for FSA Guaranteed Loans

Depending on the type of loan, prospective borrowers will have to meet certain eligibility requirements set forth by the USDA. Additionally, each participating lender is permitted to have its own set of program eligibility requirements for guaranteed USDA farm loans. Below are examples of general eligibility requirements for Guaranteed Farm Ownership Loans, Guaranteed Farm Operating Loans and Guaranteed Conservation Loans. However, Conservation Loan applicants do not have to meet the “family farm” definition, nor do they have to be unable to obtain a loan without an FSA guarantee. For more information on Land Contract Guarantee eligibility requirements which are not included below, click here.

- Applicants must be a citizen of the U.S. (or legal resident alien), which includes Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and certain former Pacific Trust Territories.

- Applicants must have an acceptable credit history as determined by the lender.

- Applicants must have the legal capacity to incur responsibility for the loan obligation.

- Applicants must be unable to obtain a loan without an FSA guarantee.

- Applicants must not be delinquent on any Federal debt.

- Applicants must not have caused FSA a financial loss by receiving debt forgiveness on more than three occasions on or prior to April 4, 1996, or any one occasion after April 4, 1996, on either an FSA direct or guarantee loan.

- Applicants must be the owner-operator or tenant-operator of a “family farm” after the loan is closed. For an Operating loan, the producer must be the operator of a family farm after the loan is closed. For a Farm Ownership loan, the producer also needs to own the farm.

If you are thinking about borrowing money to start or expand your farm business, it’s important to know your options before starting the application process. Experienced FSA lenders like Capital Bank, and insurance providers like Capital Insurance Agency, can help make financial recommendations more efficiently when prospective borrowers are prepared to share their program(s) of interest.

Our team of FSA lending experts is ready to talk!