SBA 7(a) financing is one of the most common ways for small businesses to access capital for growth and business expansion. As highlighted in our recent articles, these loans offer low interest rates and long repayment terms, but navigating the application process can be difficult for many potential borrowers.

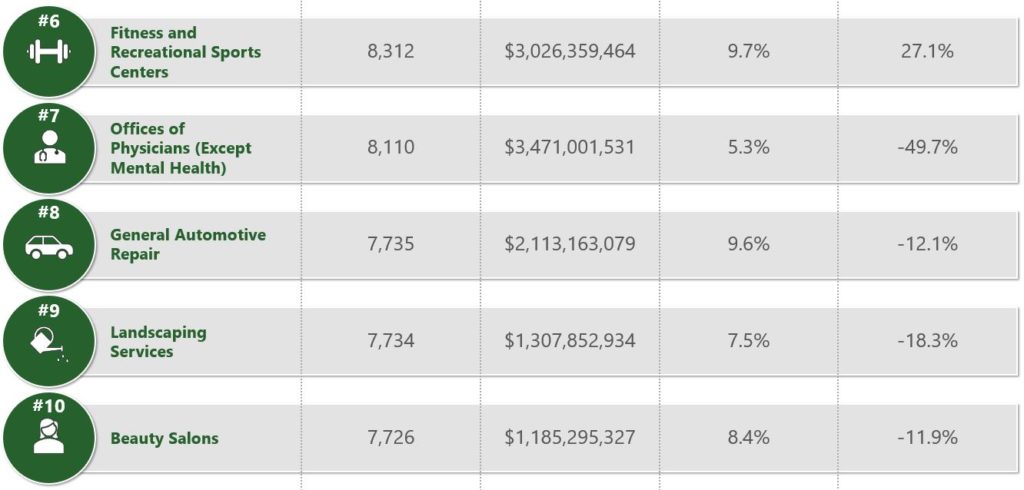

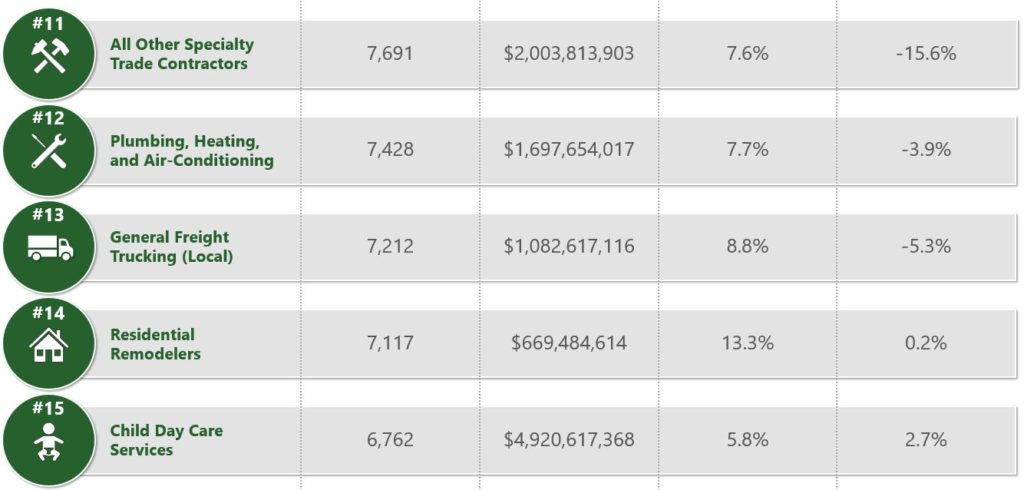

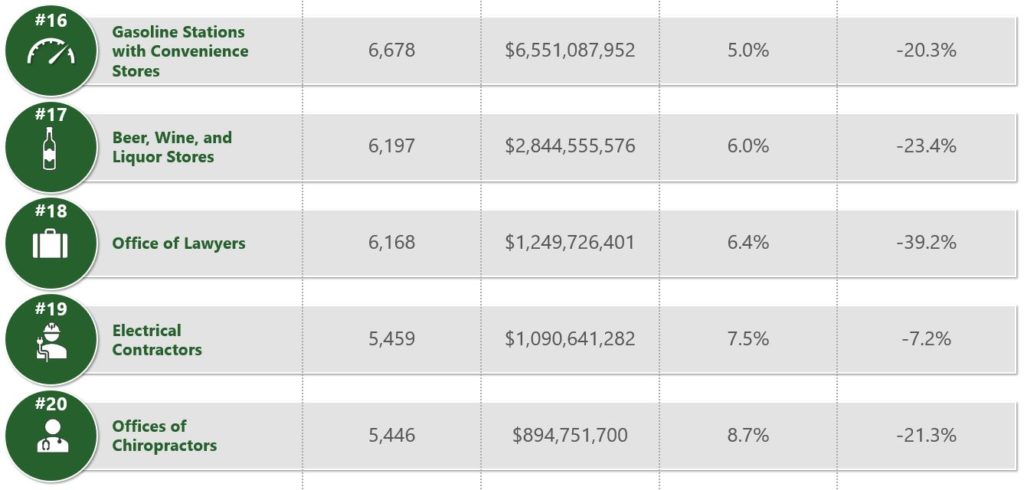

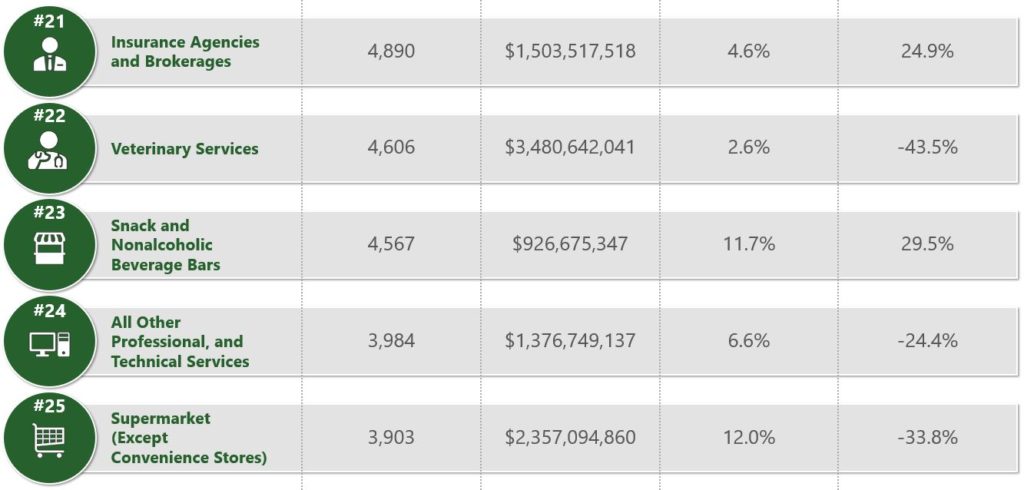

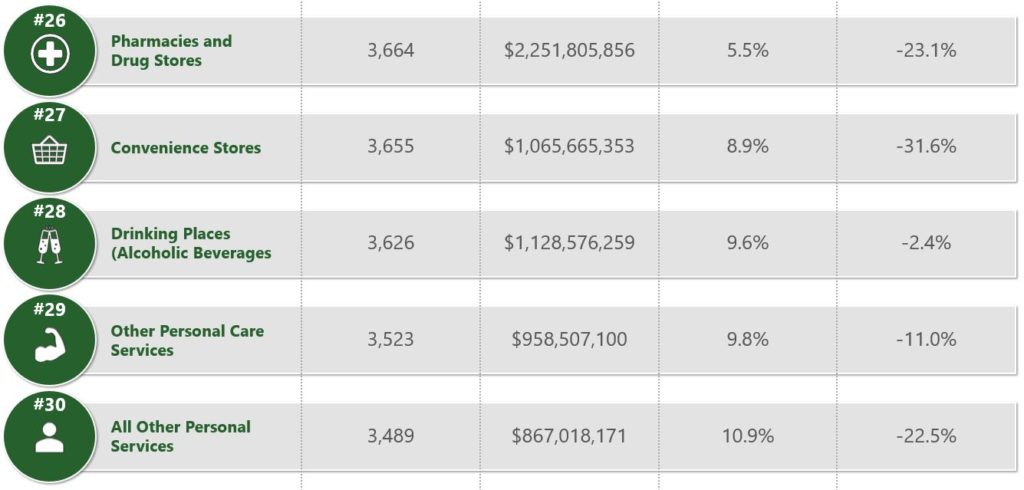

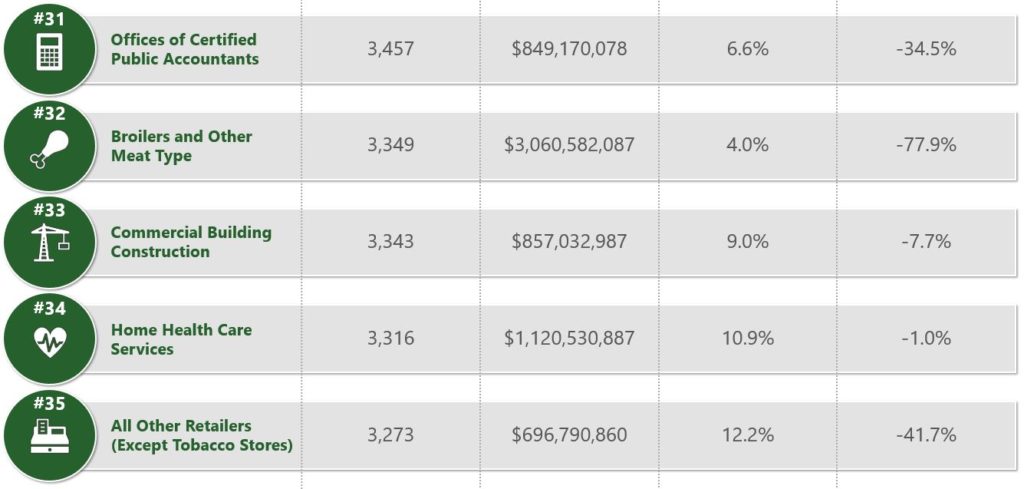

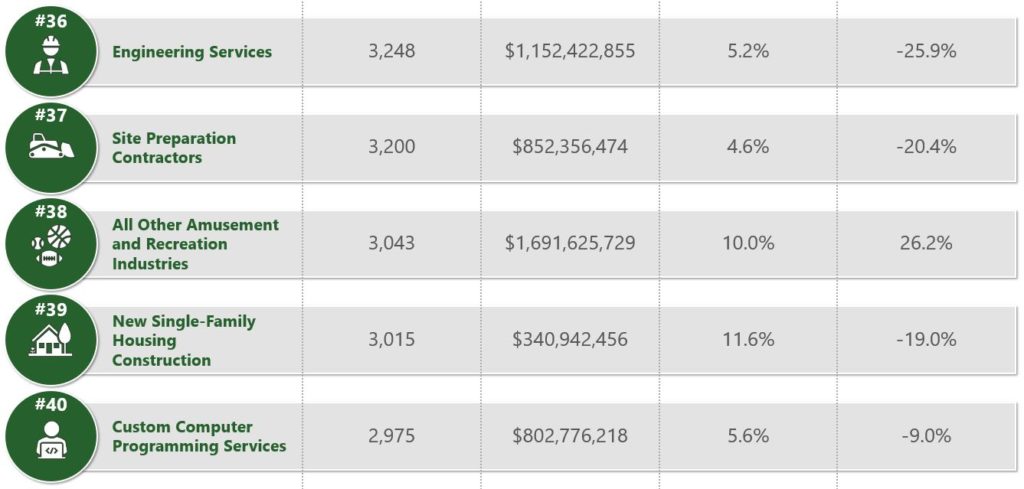

In this article, we explore key performance metrics among the most common industries that receive financing through the SBA 7(a) Loan Program. All findings in this article come from an analysis of the top 40industries that have obtained the highest gross number of loan approvals from October 1, 2009, to September 30, 2019 (SBA’s Fiscal Year-End) according to the SBA 7(a) Loan Data Reports on SBA.gov.

Highest-Volume Industries

Over the last decade, more than 545,000 borrowers have benefited from over $200 billion in approved loans through the program. Approximately 50% of the total dollar volume can be attributed to the top 40 industries during this period.

For the top five highest-volume industries, defined as the number of applications submitted and approved, full-service restaurants (28,680), limited-service restaurants (19,141), dentists (10,699), general freight and trucking (8,959) and hotels (8,618) top the list, respectively.

Top Industries for SBA Financing

*Charge-Off Rate FY2010-2019 = # of Charged-Off Loans / (# of Paid-In-Full Loans + # of Charged-Off Loans)

**Growth Rate FY2015 v. FY2019 = (# of Loans FY2019 – # of Loans FY2015) / # of Loans FY2015

Top Performing Industries

To determine the top performing industries among this group, we evaluated charge-off rate by dividing the total number of loans charged-off by the total number of loans either paid in full or charged-off during the ten-year period. Hotels (2.4%), veterinarians (2.6%), dentists (2.8%), broilers and other meats (4.0%) and insurance agencies (4.6%), ranked as the top five industries with the lowest charge-off rates. Note, this calculation does not include canceled applications that were approved, loans with an outstanding balance or loans that have not yet been recognized as charged-off. To learn more about when a charge-off can officially be justified, see when is a charge-off justified on SBA.gov.

Fastest-Growing Industries

The fastest growing industries among this group were determined by looking at the percentage of growth by number of loans over the past five years (FY2015-2019) across each of the top 40 industries. Snack and non-alcoholic beverage bars grew the fastest, up from 471 approved loans in FY2015 to 610 in FY2019 (29.5% increase). Other industries that experienced growth during this period include fitness and recreational sports centers (27.1% increase), amusement and recreations industries (26.2% increase), insurance agencies (24.9% increase) and child day care services (2.7% increase). Note, the total number of loans approved through the SBA 7(a) Loan Program decreased by 18.2% during this period (63,461 in FY2015 to 51,907 in FY2019).

You can tell from this article that certain industries utilize SBA loans far more than others. Entrepreneurs in these fields may want to seriously consider SBA financing to fuel growth. It’s also important to keep in mind that if your industry did not rank as one of the top industries for SBA financing, small business lending may still be an attractive option, as over 1,200 different industries were approved for an SBA 7(a) loan from FY2010 to FY2019.

To see if SBA financing is the right option for your business, contact West Town Bank & Trust at (855) 693-8290 to speak with one of our experts today.

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

Since 2011, West Town Bank & Trust has authorized government guaranteed loans for nearly 150 industries.