If you’re a small-business owner looking for capital to expand, you’ve likely come across SBA 7(a) loans – the nation’s most popular type of loan offered through the U.S. Small Business Administration (SBA).

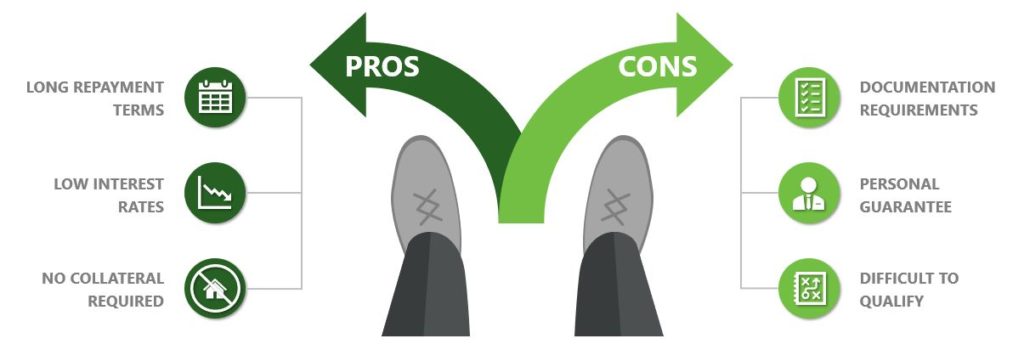

Let’s look at SBA loans pros and cons to see if a 7(a) loan is right for you.

Perhaps the biggest misconception about these loans is that the SBA lends directly to small businesses. In reality, the SBA 7(a) Loan Program partially guarantees loans made by banks or other direct lenders to eligible small-businesses. The program aims to promote economic growth by encouraging lenders to partner with small businesses that may be struggling to secure financing on reasonable terms. Because of the guaranty, SBA loans tend to have lower monthly payments than other types of loans. However, there are some drawbacks that must be considered prior to starting your application.

To help determine if a 7(a) loan is right for your business, let’s review the pros and cons.

The Pros of SBA Loans

- SBA Loan Pro: Long Repayment Terms

The program offers fully amortizing terms up to 10 years on non-real estate transactions like working capital, equipment or inventory purchases. Longer maturities result in drastically lower monthly payments and conservation of cash flow, creating an opportunity to grow your business faster. In addition, the program allows you to refinance existing debt that may be too expensive.

- SBA Loan Pro: Low Interest Rates

As opposed to online short-term loans which tend to have extremely high rates, the SBA sets maximum interest rates that lenders can charge on 7(a) loans. The maximum interest rate is determined by the size of the loan but typically will not exceed 6.0% (WSJP + 2.75% as of May 18, 2020).

- SBA Loan Pro: No Collateral Requirements

The SBA guaranty helps offset risk, giving financial institutions the flexibility to consider transactions not fully collateralized by business or personal assets. When applying for a traditional bank loan, lenders often require a loan to be fully collateralized by real estate or other tangible assets. Collateral shortfalls are one of the most common reasons credit might not be available elsewhere on reasonable terms, making a small-business eligible to obtain financing through the program.

The Cons of SBA Loans

- SBA Loan Con: Documentation Requirements

The application and funding process can appear to be cumbersome and can take up to several weeks (depending on borrower responsiveness). However, for “small loans” *under $350,000, the SBA prescreens applicants and allows lenders to fast track your application upon meeting certain criteria.

*According to SBA.gov, the number of “small loans” approved through the SBA 7(a) Loan Program in FY2019 represented 72% of all loans approved through the program during this period.

- SBA Loan Con: Personal Guarantee

Lenders will require you to sign a personal guarantee if you own 20% or more equity in the business. If you’re unable to make payments down the road based on the original agreed-upon terms, you’ll need to pay back the lender from your personal accounts or assets.

- SBA Loan Con: Difficult to Qualify

Personal credit and business financials must be solid. The SBA guaranty doesn’t make a bad loan good – it simply makes a good loan stronger and is meant to assist credit-worthy small businesses. While some lenders may only consider 650+ credit scores, others may look at the overall health of your business, including the ability to meet the SBA’s Debt Service Coverage Ratio (DSCR) required minimum of 1.15x.

Although SBA 7(a) loans require investment of time and effort, the overall benefits of the program outweigh the costs for many small-business owners.

If you’re searching for the least expensive and most flexible option, 7(a) loans should be on your radar. While factors like timing and the amount of paperwork matter, extended maturities and lower interest rates tend to have the most profound impact on your business long-term. After taking a look at SBA loans pros and cons, be sure to do your research and consult a preferred lender or lender service provider to ensure you work with a highly qualified partner who optimizes your potential for success.

To see if SBA financing is the right option for your business, contact West Town Bank & Trust at (855) 693-8290 to speak with one of our experts today.

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.