Anyone that has touched the Paycheck Protection Program (PPP) in some way, shape or form – business owners, bankers, accountants or otherwise – can likely agree that the only certainty has been uncertainty these past eight months.

On March 27, 2020, the President signed into law the Coronavirus Aid, Relief and Economic Security Act (also known as the CARES Act). Shortly thereafter, the $660 billion program was born in a flash as the SBA and Treasury scrambled to set program guidelines that would allow lenders to get funds into the hands of millions of business owners in dire need of a lifeline in the midst of a surging pandemic. Rules were established in less than one week and the issuance of subsequent guidance along the way, such Interim Final Rule updates and FAQ documents, have often raised more questions than answers. This has left many businesses turning to CPAs for clarity to help navigate the confusion.

PPP Forgiveness Process

On August 10, 2020, the SBA opened its doors to start accepting forgiveness applications from PPP borrowers. With more than 5.2 million PPP borrowers starting to work through the process to receiving full forgiveness, CPAs are under pressure to help manage and navigate the PPP forgiveness process. To help CPAs clearly articulate the situation to business owners, let’s first take a look at what CPAs need to know about five different areas of the PPP forgiveness application process.

1. Forgiveness Application Forms

Borrowers must apply for forgiveness through the lender that disbursed its PPP loan, not directly with the SBA. The first step is to complete one of the three forgiveness application forms, dependent on the borrower’s PPP loan amount and circumstances. Per SBA data released on August 8, 2020, the vast majority of PPP borrowers are eligible to use SBA Form 3508S, the most simplified version of the three options, which include:

- SBA Form 3508S – Borrowers that received $50,000 or less (68.6% of all PPP borrowers).

- SBA Form 3508EZ – Borrowers that received $50,001 or more and did not reduce employee levels, wages and hours.

- SBA Form 3508 – Borrowers that do not qualify to use Form 3508S or Form 3508EZ.

2. Application Submission Dates

As long as a borrower submits its loan forgiveness application within 10 months of the completion of the “Covered Period” – defined as the period a borrower is eligible to use its PPP proceeds – the borrower is not required to make any loan payments until the final forgiveness amount is remitted to the lender by the SBA. The PPP Flexibility Act (PPPFA) signed into law June 5, 2020, extended the Covered Period from eight (8) weeks to 24 weeks. For loans funded prior to June 5, 2020, borrowers can choose to keep the original eight (8) week Covered Period or move to the 24-week period. If the loan was funded after June 5, 2020, the borrower must adhere to a 24-week Covered Period.

3. Lender Review & Decisioning

Upon receiving a PPP forgiveness application, the lender has 60 days to issue a decision regarding forgiveness of the PPP loan to the SBA. During those 60 days, the lender must confirm receipt of the borrower’s complete application, certifications, supporting documentation and calculations that at least 60% of the loan forgiveness amount requested is attributable to eligible payroll costs with the remaining 40% attributable to eligible non-payroll costs. It is the borrower’s responsibility to provide accurate calculations, but lenders are expected to perform a “good-faith” review. If the lender identifies calculation errors or a material lack of substantiating documentation, the lender should work with the borrower to correct any issues. Once the lender makes a PPP loan forgiveness decision, the decision is then issued to the SBA.

4. SBA Review & Decisioning

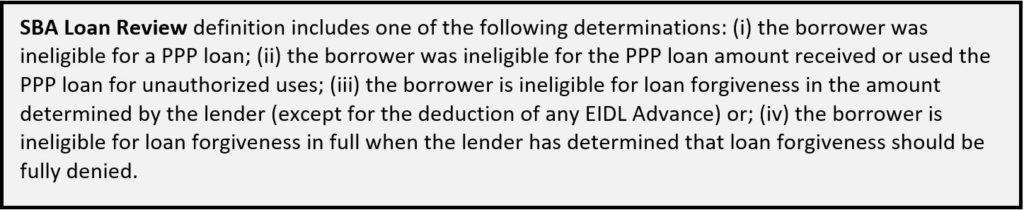

After the lender issues its PPP loan forgiveness decision to the SBA, the SBA has 90 days to validate or deny the lender’s decision and remit the appropriate forgiveness amount, including accrued interest, to the lender. Although nothing is set in stone, borrowers that received a PPP loan in excess of $2 million will likely be required to complete and return a PPP loan Necessity Questionnaire (either SBA Form 3509 for for-profit businesses or SBA Form 3510 for non-profit businesses, although both forms are still unofficial) within 10 days of receipt from the lender. While the microscope may lean more heavily on this demographic of borrowers, all PPP borrowers may be subject, at any time, to the SBA’s review of borrower eligibility, unauthorized use of funds and loan forgiveness, in the SBA’s sole discretion. All borrowers and their advisers should have a general understanding of what an SBA Loan Review is and how to appeal an adverse decision from the SBA, if necessary.

5. Borrower “Right to Appeal”

If a borrower faces an adverse SBA Loan Review decision (defined below), it must respond quickly. In order to appeal the SBA Loan Review decision to the SBA Office of Hearings and Appeals (OHA), a borrower must file a petition with OHA within 30 calendar days after receiving the final decision or being notified by the lender of the final decision. Any decision that does not fall under the definition of an SBA Loan Review cannot be appealed to OHA. For example, there is no appeal option for a borrower if the lender partially approves forgiveness and the SBA remits the partial PPP loan forgiveness amount.

Moving Targets

Additional PPP guidance remains forthcoming. Borrowers and their advisers must not only understand the general process when applying for forgiveness, but also the many gray areas within guidance that can easily be misinterpreted or changed upon further direction from Washington. Here are some of these “moving targets” to consider prior to filing for forgiveness, many of which will only be applicable to specific situations for specific borrowers:

Early Borrower Submissions

While early applications are permitted, the eight (8) or 24-week Covered Period must be considered. Whether it’s eight (8) weeks or 24 weeks, borrowers may apply for forgiveness before the end of the Covered Period. However, doing so lowers the maximum eligible compensation. If a borrower exhausts its PPP funds for eligible expenses and chooses to apply for forgiveness 16 weeks after the start of the Covered Period, the period would still be 24 weeks and compensation maximums for employees would be prorated, less than the compensation maximum for employees of borrowers with a 24-week Covered Period. In this example, it becomes quite ambiguous if the borrower makes employee changes impacting compensation maximums during the Covered Period at week 22 but elected to apply for early forgiveness at week 16. The prorated compensation maximums at the time the application was submitted for forgiveness would not be accurately reflected as the law is currently written.

Blanket Forgiveness

Since the PPP forgiveness process can be tedious, even with simplified forms for certain borrowers, members of Congress have proposed legislation that would allow for a much more streamlined PPP forgiveness process. There is anticipation among lenders and borrowers alike that loans of $150,000 or less will automatically receive full forgiveness with a certification by the borrower that the money was used according to guidelines. As talks continue to press forward on this idea, there is a possibility that “blanket forgiveness” for the more than 87% of all PPP borrowers that fall in this category won’t ever be granted by Congress. For borrowers meeting this description that have yet to prepare the documentation required for PPP forgiveness submission, it might make sense to wait and see how the pending rule shakes out prior to moving forward with filing for forgiveness.

Deducting Expenses

IRS Notice 2020-32 declared that no tax deduction is allowed for an expense that is otherwise deductible if the payment of the expense results in forgiveness of a PPP loan. This argument states that allowing the deductibility of expenses paid with PPP funds would result in borrowers “double dipping”. Hundreds of organizations, including the American Institute of Certified Public Accountants (AICPA), are urging Congress to allow full deductions for PPP-related expenses given the severity of COVID’s impact on businesses across the country. There is a case to be made that Congress originally had intended PPP expenses to be deductible and lawmakers from both parties have voiced support for this position with no material action yet to be settled. Should full deductions for PPP-related expenses be allowed, eligible tax years start to get dicey for borrowers that incurred these expenses during a specific fiscal year but didn’t receive forgiveness until the following fiscal year.

Economic Injury Disaster Loan (EIDL) Advances

The EIDL Program was activated several weeks before Congress passed the CARES Act, making it the first Federal small business aid program to address the economic crisis. Different than PPP, EIDL loans were handled directly by the SBA rather than through private lenders so entrepreneurs that didn’t have deep banking-industry connections could swiftly access relief. Due to the enormous backlog of EIDL applicants, SBA offered an immediate EIDL Advance (up to a $10,000 maximum) within three days of applying for an EIDL loan, meant to serve as an interim but vital source of funds while applicants awaited a decision on their EIDL loan application. To access the EIDL Advance, recipients first had to apply for an EIDL loan but did not have to be approved to receive the EIDL Advance. However, those that were also applying for a PPP loan were asked to net the EIDL Advance that had been received out of the request for PPP funds. Whether borrowers overlooked netting out the EIDL Advance or had yet to receive EIDL Advance funds at the time the initial PPP loan application was submitted, these businesses are now having the amount of the EIDL Advance subtracted from the PPP loan forgiveness amount. This has many up in arms as guidelines originally stated the EIDL Advance did not have to be repaid. Nearly six million small businesses secured an EIDL Advance and rumors continue to float around as to whether this rule will stand.

Business Structural Changes

Countless borrowers have had to revise business structures in the face of the pandemic. Alterations to a company’s legal structure, a decrease in employee count or eliminating a business division after a borrower receives a PPP loan may impact the borrower’s ability to receive full, or partial, PPP loan forgiveness. On October 2, 2020 (almost two months after PPP forgiveness applications could start being accepted), the SBA released a Procedural Notice concerning required procedures for changes in ownership of an entity that has received PPP funds. Under the Procedural Notice, a Change of Ownership will be considered to have occurred when either: (i) at least 20% of ownership interest of a PPP borrower is sold or transferred; (ii) the PPP borrower sells or transfers at least 50% of its assets; or (iii) a PPP borrower is merged with another entity. In addition, SBA approval or funding PPP loan balances into escrow may be required in connection with a Change of Ownership transaction and purchasers may be required to assume the PPP borrower’s obligations. If the PPP loan is in place and lender consents are required, then the parties need to consider whether the Change of Ownership transaction could trigger a default under the PPP loan documents and a loss of potential forgiveness.

What Can CPAs Do Now Relative to the PPP Forgiveness Process?

Be Patient

For CPAs to effectively help business owners reach the forgiveness finish line, basic knowledge of the overall process is required, as well as an understanding of certain gray areas and potential rule changes that may impact forgiveness decisions depending on a borrower’s situation. If rule changes are still in limbo that could be significantly beneficial to a client’s forgiveness consideration, the best thing to do is to be patient.

Borrowers and their advisers must not only know the rules, but also how to use existing guidance in place to come to reasonable conclusions. This is where the best judgement scenarios from CPAs come into play.

Document Everything

This cannot be stressed enough. Not only do PPP forgiveness applications require the accompaniment of detailed supporting documentation, the SBA has the right to request retained borrower information as part of its review at any time. If a borrower does not promptly provide the information being requested, this may cause a delay in PPP forgiveness processing and decisioning. In addition, it’s a general best practice to keep a paper trail of evidence supporting conclusions that were made along the way. Not to mention, the SBA requires that a borrower maintain its PPP loan documentation for up to six (6) years after the date forgiveness is received.

Through its access to intake, documentation and closing software, West Town Bank & Trust processed hundreds of PPP loans, helping preserve and maintain thousands of jobs across America throughout the pandemic. In addition, working directly with a Lender Service Provider (LSP), which helped process more than 17,000 PPP loans on behalf of nearly 50 lenders, allowed a community bank like West Town Bank & Trust to gain access to knowledge from all angles of the PPP lending process given the high volume handled by its LSP. If you are a CPA in need of a lender’s perspective of the PPP forgiveness process, please do not hesitate to give us a call at (919) 647-9581.

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

About the Author: Earl has over 18 years and is responsible for creating the strategic direction and coordinating the execution of directives of the Bank’s lending services as set forth by the Executive Management Team. This includes supervision of all department managers within government lending, loan operations, credit administration and underwriting, while ensuring each vertical operates in accordance with established policies and procedures. To learn more, email Earl at edonnelly@westtownbank.com or call (919) 647-9581.