The Small Business Administration’s popular loan program offers long-term capital to buy a business while preserving cash flow long term.

- The specialized loan program lowers monthly payments by spreading out the loan over a longer term. It’s good for financing large purchases while helping business owners retain capital that can be reinvested back in the business.

- You can use an SBA 7(a) loan to buy a business if you meet the eligibility requirements.

- Businesses that operate with low collateral, are a newly emerging industry, and/or face other barriers to conventional financing are typically the best candidates for using an SBA loan to buy a business.

The Small Business Administration’s popular 7(a) Loan Program helps thousands of entrepreneurs secure financing every year to start, grow, or buy a business. We often point business owners to the SBA 7(a) Loan Program because it offers unique terms and benefits. When managed properly, this loan can help entrepreneurs maximize their investment back into their business during an acquisition.

Since 2020, West Town Bank & Trust has financed nearly $50 million in business acquisition loans through its government-guaranteed loan programs. Below, we’ve outlined why SBA loans are a great resource for buying a business and how our clients have leveraged them to conserve cash flow.

SBA 7(a) Loans: How It Works for Entrepreneurs

These loan programs offer extended repayment terms and competitive interest rates. They also make funding accessible to business owners who might not qualify for conventional bank financing. These unique benefits are made possible thanks to the SBA’s government guarantee of the loan.

When a loan is referred to as “government-guaranteed” it essentially means the government absorbs a large portion of the risk that lenders traditionally must take on when they offer a loan to a business.

Less risk enables your bank to offer more competitive terms even if the borrower wouldn’t traditionally qualify for them.

In this case, less risk means extended repayment terms and competitive rates. Financing with an SBA loan enables you to access these unique benefits while lending you the support of America’s Small Business Administration in addition to capital.

An important note: The loan is backed by the SBA, but it’s actually funded by a participating bank or approved SBA lender. You’ll still go through a bank to apply for your loan and will work with the lending institution to fund it.

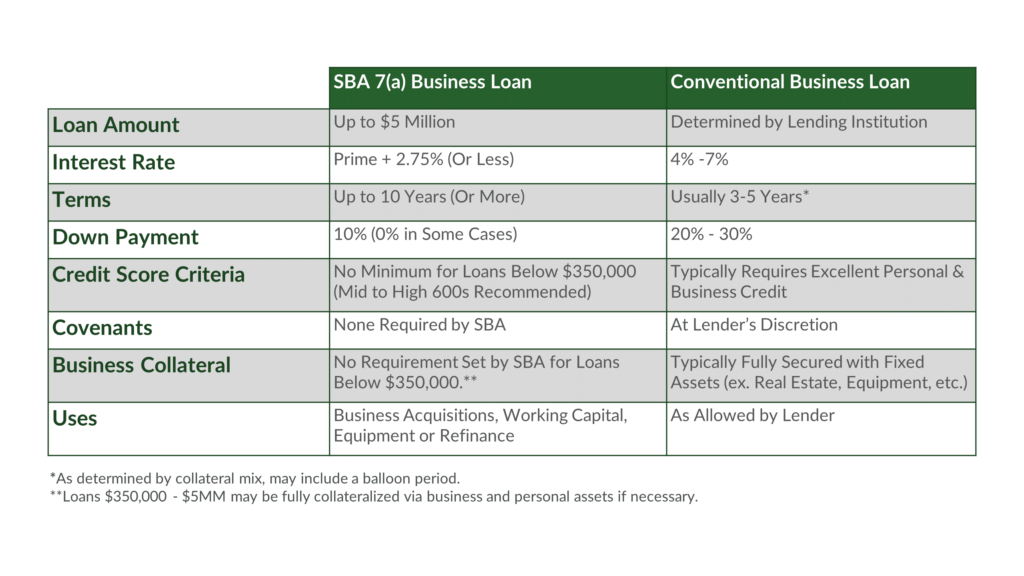

The table below compares SBA 7(a) Loans to conventional loans. At a glance, you’ll notice the SBA 7(a) loan’s benefits typically include longer terms, smaller down payments, and more flexible ways to use the funds.

Using an SBA 7(a) Loan for Business Acquisitions

Business acquisitions are one of the many eligible uses of proceeds for a 7(a) Loan.

You can use an SBA 7(a) Loan for:

- Buying a book of business

- Buying another practice

- Partner buyouts

On top of financing acquisitions, you can use an SBA loan to access working capital, refinance debt, hire employees, pay for marketing costs, purchase real estate, and more. If it’s something you need to do to grow your business, you might be able to use an SBA loan to cover the costs.

The Big Idea: Protect Cash Flow While Paying Off Your Business Loan

An SBA 7(a) loan is good for buying a business because it enables eligible business owners to borrow a large sum with competitive terms and long repayment periods.

The Loan Program approves loans up to $5 million to be paid back over a standard 10-year term. A conventional loan term can typically range from 3-5 years on average.

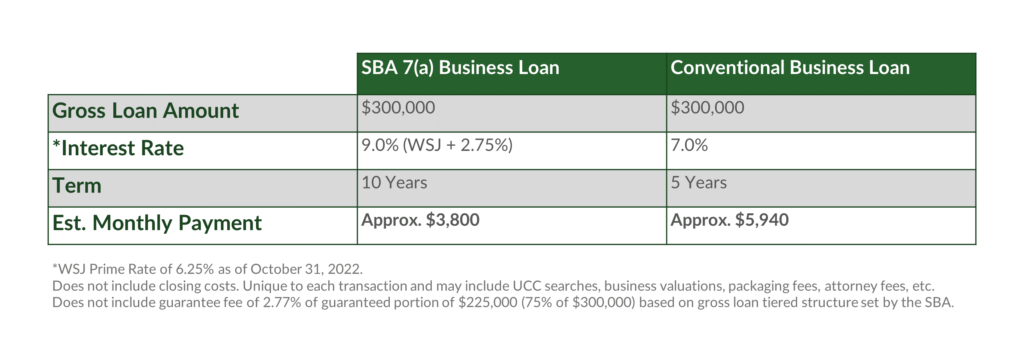

The table below breaks down how those terms impact a business owner’s monthly payment on the loan. Let’s use a hypothetical interest rate of 7.0% for the conventional loan and 9.0% for the SBA loan (an SBA loan’s interest rate is variable but is typically calculated with WSJ Prime + 2.75%*). We’ll keep the loan amounts the same. In this case, even with the higher interest rate, the SBA loan’s 10-year term lowers the monthly payment by $2,140:

More capital stays in the business because of the extended loan repayment periods.

Additionally, the SBA loan allows business owners to fold closing costs into the loan, helping business owners retain liquidity throughout the closing process.

Both SBA loans and conventional loans will require closing cost. Closing costs may include attorney fees, the cost of business valuations, packaging fees, and UCC searches.

A conventional loan often requires the closing costs to be paid out of pocket. However, with an SBA loan, closing costs can be structured into the total loan proceeds. Meaning, less money the business owner needs to bring to the closing table.

With an SBA loan, growing companies retain some liquidity while they close and pay off their loan. The cash can then be re-invested in the business to make the most of timely opportunities.

*Interest rates are variable throughout the life of the loan and are based on WSJ Prime. Interest Rates for SBA 7(a) Loans will vary from lender to lender.

When to Use an SBA 7(a) Loan to Buy a Business

You should use an SBA loan to buy a book of business or practice when the intangible value of a business exceeds the physical collateral used to run it.

This includes industries where businesses operate with high-net-worth books of business. Financial advisors, insurance agencies, law firms, and privately owned dental or medical practices are often good candidates to use an SBA 7(a) loan for a business acquisition.

For example, let’s consider an entrepreneur who wants to buy a book of business currently priced at $350,000. A conventional loan would require a business to own fixed assets that are equal to or greater than the loan amount needed to fund the acquisition.

Meaning, your tangible assets would need to total anywhere from $350,000 – $525,000 to secure a $350,000 loan. Without expensive equipment, real estate, and assets on the balance sheet to offset the debt, you may be expected to borrow under more restrictive terms. Assuming you can secure a conventional business loan at all.

However, with an SBA loan, you can secure business-friendly terms, benefits, and competitive rates even if you can’t fully collateralize the loan with tangible assets. The SBA 7(a) loan makes it possible to invest in a new firm, practice, or book of business with a reasonable and affordable deal structure.

How to Get an SBA Loan to Buy a Business

The SBA business acquisition loan application and underwriting process at West Town Bank & Trust can be broken down into 5 phases:

1. Meet the Eligibility Criteria

You need to meet these four basic criteria to qualify for SBA loans:

- Operate in the US.

- Operate for profit.

- Be considered a ‘Small Business’ by the SBA.

- Credit score of at least 650 (banks may have different credit score requirements for SBA loans, but the industry standard is usually 650 or higher. Read more about credit eligibility requirements for SBA loans.)

If you think you meet these criteria, it’s recommended that you go ahead and pre-qualify. Our Pre-Qualification Process can be completed online in minutes with this form.

2. Speak with a Lender

One of our lenders will schedule a time to talk one on one about your business goals and growth plan. They’ll confirm your eligibility by analyzing your information and goals to determine if an SBA loan is a good fit for your next phase of growth.

If an SBA loan isn’t the right fit, your lender will share information on other financing options you might want to consider.

If you are eligible for an SBA loan and it’s a smart move for your goals, your lender will send you a list of documents to move forward with the application.

3. Prepare Buyer and Seller Documents

To use an SBA loan to buy a business you’ll need documents that breakdown your business’s financials and your seller’s. The document checklist for SBA loans includes:

- Business and personal tax returns (past three years)

- Business debt schedule

- Business interim financial statements

- Personal financial statement for all guarantors

Keep in mind, because of this requirement you cannot complete the full SBA application unless you’ve already engaged a seller. Resume the process at Step 4 once you’ve identified the business you’d like to purchase and have secured a Letter of Intent (LOI) and/or Purchase Agreement from the Seller.

4. Complete the Full SBA Loan Application & Underwriting Process

Use your collected documents to complete the full SBA 7(a) loan application. The application will go through an underwriting and closing process with the bank’s Lender Service Provider. You’ll work hand in hand with the team to complete every line item needed to apply for an SBA loan.

5. Get Funded to Buy a Business

If your loan is approved, the funds will be available for your acquisition with direct support from your lending institution. Use the money to buy your business and kickstart your growth.

Buying a business is an exciting next step to your business growth. With the right financing plan, you can maximize your investment to pay off the purchase amount while keeping cash in the business. Get started funding your business acquisition:

Pre-Qualify for an SBA Business Acquisition Loan

About West Town Bank & Trust: A financing partner should reciprocate the level of trust you’ve built around your practice. With a 100-year+ community banking history, West Town Bank & Trust works with entrepreneurs across the US to grow their businesses with proven financial solutions.

Whether you’re interested in purchasing another book of business, facilitating growth without restricting cash flow, or getting a better interest rate on your existing loan, our team of industry experts is here to help you seize the opportunity.

Our Lending Team for Specialized Business Acquisitions:

Robert Forslund, Director of Financial Advisory Lending | Rob serves as Director of Financial Advisory Lending at West Town Bank & Trust with a focus on helping advisors in all 50 states gain access to affordable capital through SBA financing. Rob has nearly 10 years of financial services experience, ranging from private wealth management to managing an SBA 7(a) small loan platform at Windsor Advantage, LLC. Before joining West Town Bank & Trust in early 2021 as a Business Development Officer, Rob managed a Paycheck Protection Program team responsible for processing over $2 billion in loan volume through Windsor’s small loan platform.